BP Pensioner Group

BP pensions policies

Pension campaigners have been searching their files for the documents provided to them by bp, which show the pension policies and the pension commitments upon which they relied. Here are hard evidence examples of such commitments going back over 30 years, policies which were never revoked by bp or the BP Pension Fund Trustees.

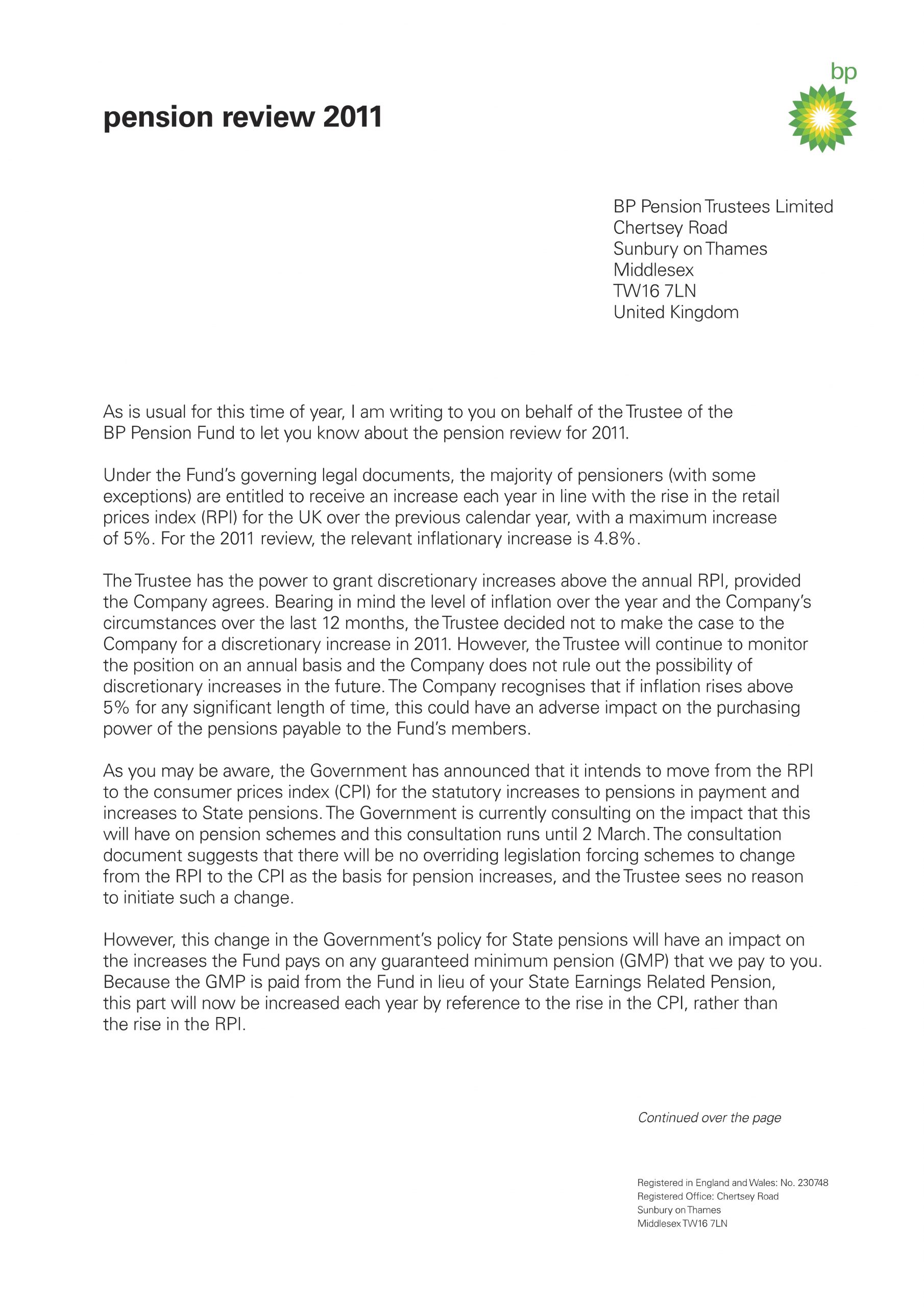

2011

Extracts from a document issued by the BP Pension Fund in 2011 on pension increases

The Trustee has the power to grant discretionary increases above the annual RPI, provided the company agrees.

and

The Company recognises that if inflation rises above 5% for any significant length of time, this could have an adverse effect on the purchasing power of the pensions payable to the Fund’s members.

2007

Extract from a document issued by the BP Pension Fund in 2007 on pension increases

what about discretionary increases?

The Trustee must make its decision strictly within the terms of the Trust Deed and the relevant scheme rules.

The Trust Deed includes a power to make discretionary increases. This is in order to provide some flexibility when circumstances are exceptional, such as price inflation being above the 5% ceiling. Any exercise of the discretion requires BP consent, so that in practice it is the Company that has the final say.

The Trustee must consider all beneficiaries in a consistent manner and hence does not have the power to tailor awards to individual circumstances. A further consideration for the Trustee is to ensure that the Fund has sufficient resources to meet its current and future financial commitments.

As explained in Pensions Highlights, the real cost of BP’s commitments has risen faster than inflation, owing to the impact of people living longer and the cost of complying with increased regulation. So the Trustee needs to maintain sufficient funding to protect and pay the benefits which members have already built up and to cope with unpredictable events.

Therefore, in all but exceptional years, members should expect incresses to follow RPI, subject to the 5% ceiling. Members of other schemes within the Fund should expect increases on the basis set out under the rules of those schemes.

Comment – Based on the BP Pension Fund’s text above highlighted in red, exceptional circumstances are exemplified as price inflation being above 5%. In 2022 RPI was 7.5% and in 2023 RPI was 13.4%

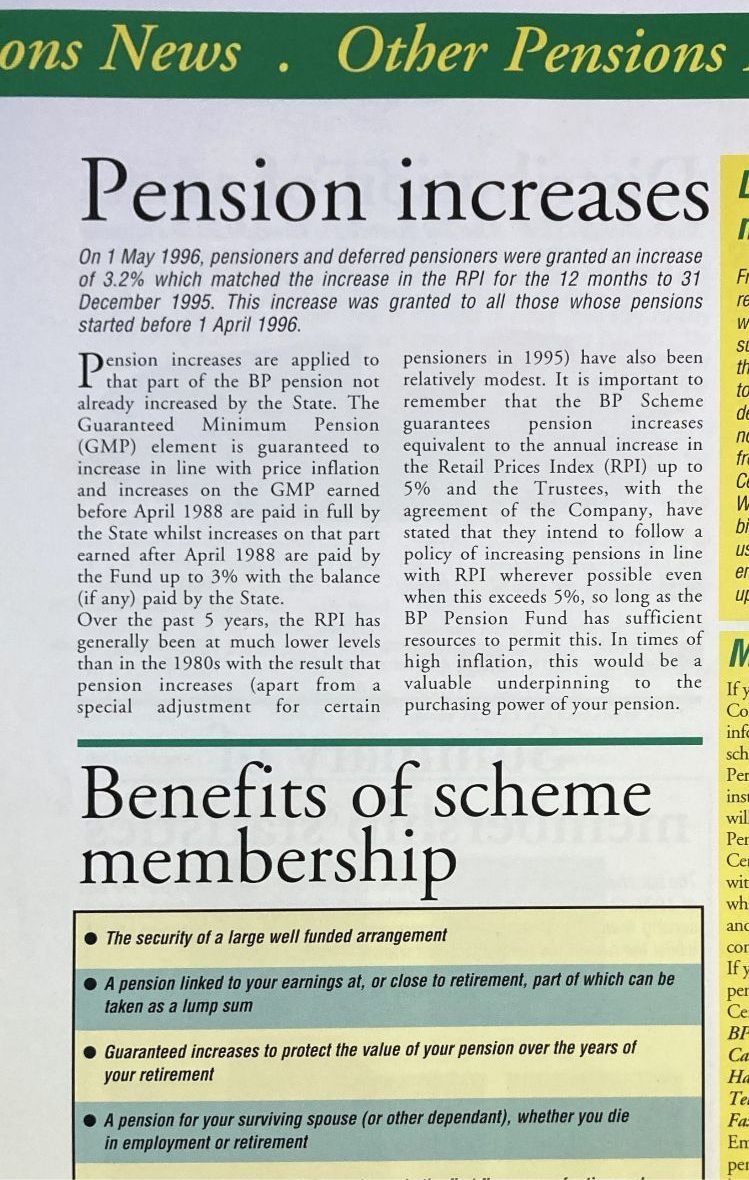

1996

Extracts from a BP Pensions newsletter

(December 1996)

It is important to remember that the BP Scheme guarantees pension increases equivalent to the annual increase in the Retail Price Index (RPI) up to 5% and the Trustees with the agreement of the Company, have stated that they intend to follow a policy of increasing pensions in line with RPI wherever possible even when this exceeds 5%, so long as the BP Pension Fund has sufficient resources to permit this. In times of high inflation, this would be a valuable underpinning to the purchasing power of your pensions.

Benefits of scheme membership: Guaranteed increases to protect the value of your pension over the years of your retirement.

1992

Extracts from a BP Pensions guide booklet

(December 1992)

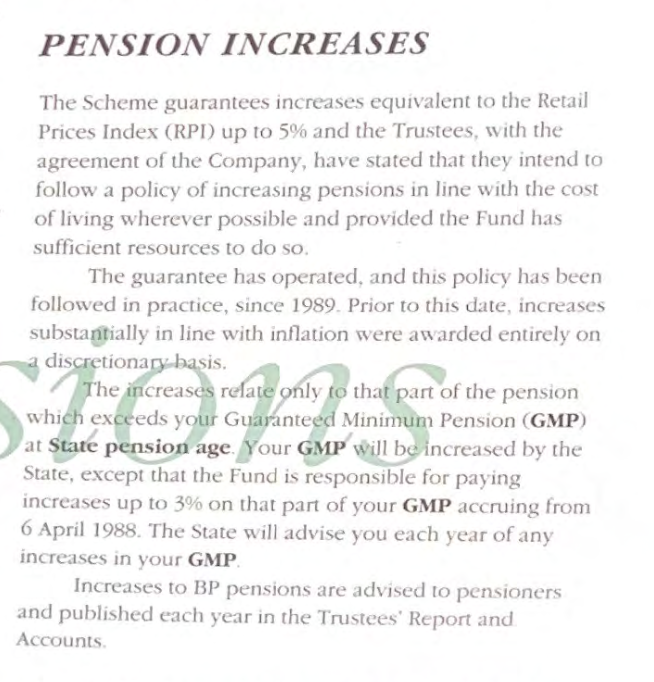

The Scheme guarantees increases equivalent to the Retail Proces Index (RPI) up to 5% and the Trustees with the agreement of the Company, have stated that they intend to follow a policy of increasing pensions in line with the cost of living wherever possible and provided the Fund has sufficient resources to do so.

This guarantee has operated, and this policy has been followed in practice, since 1989.

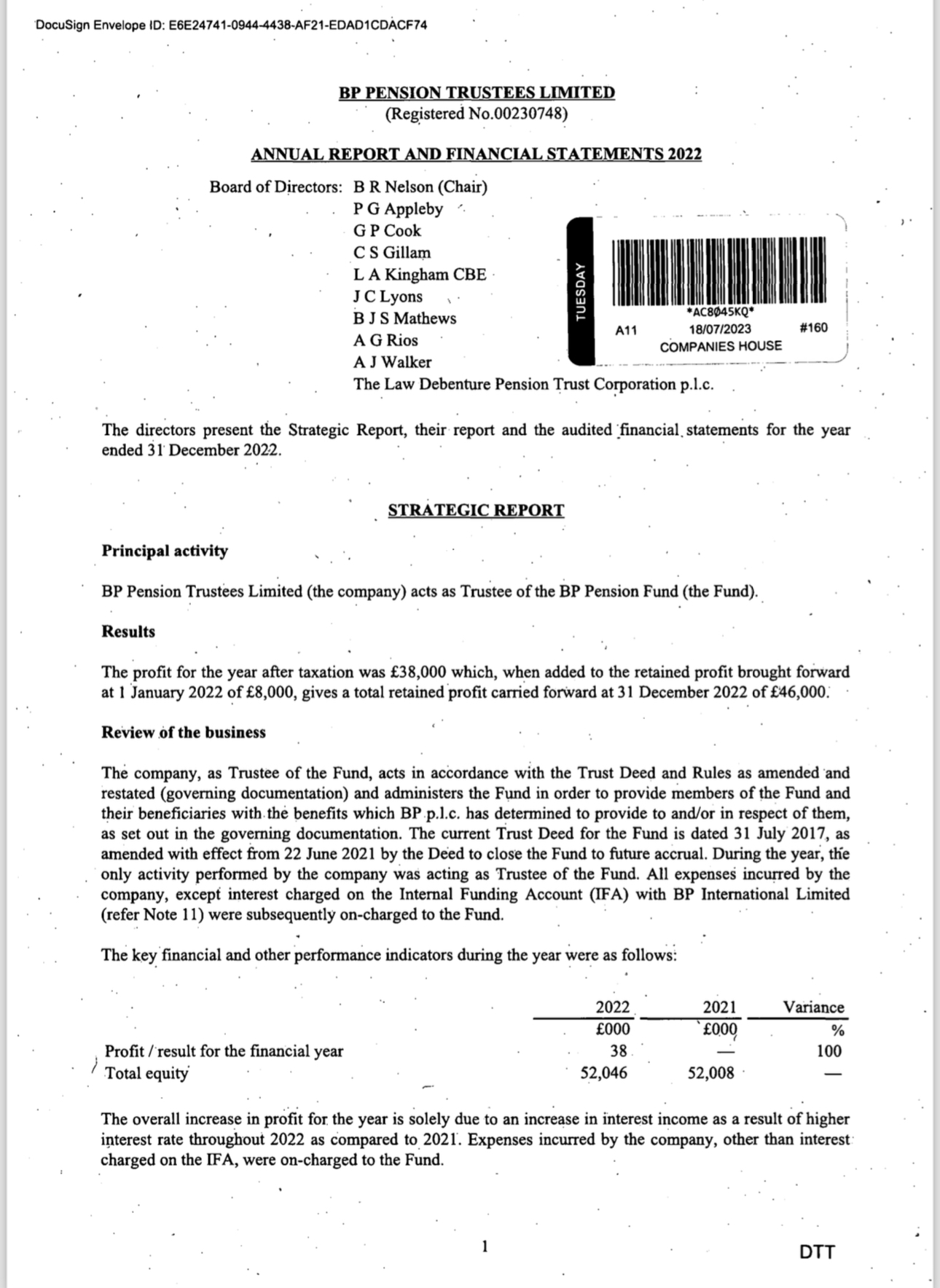

Extract from the BP Pensions Trustees Ltd Annual Report and Financial Statements 2022

(Section (f) page 2)

(f) The need to act fairly between members of the company

The board aim to balance the needs of various stakeholders when setting and delivering the company’s strategy, having regard to the Company’s regulatory obligations acting for and on behalf of the BP Pension Fund, and long term value creation including maximizing long term shareholder value.

Extract from the Pensions Regulator website on the duties and power of pension fund trustees

Act in the best interests of your beneficiaries

You must act in the best interests of the scheme’s beneficiaries. A beneficiary is anyone who is entitled to, or who might receive, a benefit from the scheme, now or in the future.

Question – how can the BP Trustees Ltd statement on directors (ie trustees) duty to maximise shareholder (ie BP) value be consistent with the legal duty of a pension fund trustee to act in the best interests of the beneficiaries (ie pension scheme members)?